opportunities for cashing in on seasonal changes

Agriculture, in the tropics, is a seasonal occupational in the sense that on farm and off farm operations are practiced depending on the seasons. During or towards the rains, households intensify field preparations, and planting.

As the rains fade and the sunny days emerge, the plantlets emerge from the necrosis, requiring tending of the fields through weeding, pest management, mulches and more. Later, the crops will reach maturity, ripe for field harvest, and farm activities give way to post harvest management of the yields.

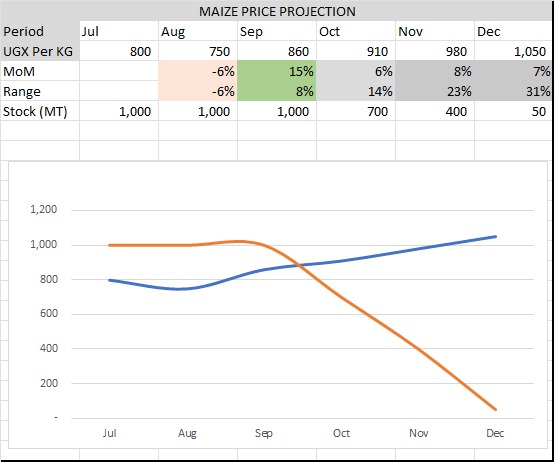

In the case of white maize grains, field preparations and planting are usually done around January- February, and July – August. Harvest is done around December – January, and June – July.

In the 5-6 month window between harvests, the fixed stock of grain, from the preceding harvest, remains the only available stock for consumption for the window.

That means that as the grain stock depletes (or is kept) in stores, the cummulative costs to keep the grain quality at optimal levels, as well as the excess buy /demand orders exceeding the available grain, create an upward pressure on prices, and the additional prices are transferable and will be paid by the buyer (market).

A consumer surplus, is established, where the market submits excess orders than supply, pushing upwards the benefits to residual grain holders. This phenomenon has, unfortunately, been the facilitating factor for speculators in grain trade, who attempt to bias the pace and direction of price changes by creating and spreading mis-information and disruption.

In a good predictive environment which has no extreme events (such as floods, droughts, wars), upward pressure on prices has previously been observed to increase by as much as 5 – 10 percentage points, month on month.

This implies that grain trade can yield anywhere between 20% – 50% gain on opening prices, making agricultural commodities perhaps the more legitimate and lucrative trades.

The above cycle repeats season on season, year on year.

As a participant in the trade, any stock owner would have to ensure they hold their stock at season opening, when the lowest possible prices are more likely, rather than expecting to benefit from swing trades mid-season.