Invest with Us!

Agahikaine Grains Ltd is offering you the opportunity to invest in commodity futures (holding commodity stock such as white maize grain safely in store today, and putting it on the market later, when the demand has increased prices to a projected level, at a profit)

We are now accepting, and issuing warehouse receipts for, contracts of UGX 5m minimum.

Just, how does it work?

PRODUCT SUMMARY

- Client will Deliver Maize Grain to Company Silo [cost to be paid by Buyer of Maize]

- Company Weighs, Cleans and Dries the Grain [free to the Grain Owner, cost to be paid by the Buyer of Maize]

- Company Holds the Grain in its Warehouse Facility, on Owner’s behalf, for the period until Future Price Y. Company regularly updates Client on price changes and market conditions

- Company sells the Grain at the Future Price, Y, at future date

- You receive the new sum of (a) Your Original Grain value plus (b) The Increase in Value of Grain (New Price – Opening Price), minus (c) Costs of the Company in managing the grain contract (drying, cleaning, storage, marketing, insurance)

Does the company guarantee return to the client? What information does the company rely on to guarantee the return?

This model of futures trade does not include a guarantee for return to investment. At a future date, this should be possible.

For the moment, we rely on a good history of grain operations; we have observed seasonal price movements for white maize grain for 10 years or 20 seasons, and are certain that the typical price adjustments, graphed below, occur repeatedly on account of seasonal demand changes for corn from the opening price (when fields are harvested) across the 5-6 months window when the next harvest occurs.

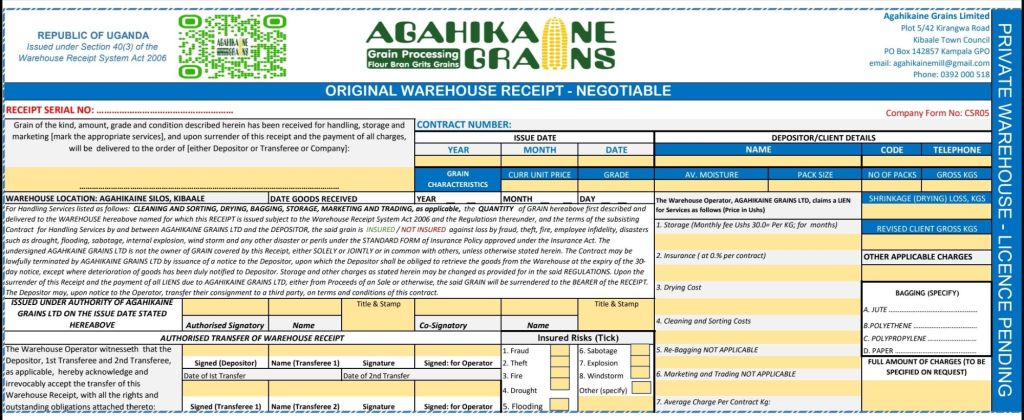

Warehouse receipts – an efficient way to transfer stocks and risks

Your stock will remain as physical grain in our silo and warehouses. You are welcome to arrange site visits and inspection, after giving notice to the company 24 hours prior, so that you obtain confirmation and assurance of the safety and solidity of our grain management system.

Every depositor is entitled to receive, from the company, a serialised warehouse receipt. The warehouse receipts will become transferable from the depositor, to any other third party, or to the company for value, if it becomes necessary for the depositor to transfer their stock.

The company has engaged local commercial bank institutions to cooperate, where the banks recognise the receipts, as well as assign independent commodity managers to give additional assurances on stock quality and availability.

A simple illustration of Grain Trade option

SAMPLE CONTRACT

Client AB wishes to purchase and hold a Grain Contract worth UGX 10 million when Grain Opening (Spot) Price is UGX 500= per kg. Client wishes to sell the Grain Contract when the Future Price reaches UGX 800= per kg.

The Company has received Client AB’s request to buy or receive grain into storage at current price of UGX 500= per kg. Grain currently at 20% moisture content, and will require drying and cleaning. Grain prices are projected to reach UGX 800= per kg after 4 months

The Company charges UGX 30= per month to store a kilogram of maize (all costs). However, the two Parties negotiate and agree to a rate of UShs 25= per kg per month, to be paid later, by the buyer of maize

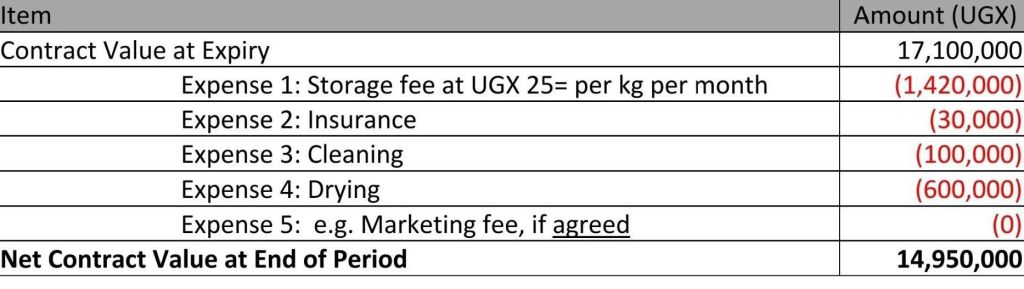

The Company and Client AB therefore agree to a contract on the following projected terms;

- The Grain Owner has 20 metric ton (20,000kgs), at UGX 500= per kg

- The Company cleans and dries the grain (reduces its moisture) from 20% w/w to 14% w/w (or 6% shrinkage in weight). The total number of kilograms expected to be lost due to water/moisture loss is 1,100 kgs. Therefore, the client net contract volume is revised to 18,900kgs on account of moisture reduction

- Drying: 20,000kgs X 6% X UGX 500, equals UGX 600,000=

All these fees become payable by the buyer of maize at the end of contract.

- The Client agrees (or Instructs the Company) to sell the contract grain when the future price reaches UGX 900= per kg

- The market price reaches UShs 900= per kg after 3 months

- The Grain contract value, at expiry, is 18,900kgs X UGX 900=, giving a total UGX 17,100,000=

- The Company storage charges, against the Client account, are UGX 25= per kg X 18,900kgs X 3 months = UGX 1,420,000=

- The costs of electricity and product handling at receiving the grain, is estimated up to 2% of contract value. The cost of Insurance of grain in store is 0.3%.

- Total costs at contract signature will be

- Insurance: UGX 10million X 0.3%, equals UGX 30,000=

- Cleaning: 20,000kgs X 1% X UGX 500, equals UGX 100,000=

- Further, the one-off costs at grain receiving (Insurance, Cleaning and Drying) total UGX 730,000= are also charged.

- Insurance: UGX 10million X 0.3%, equals UGX 30,000=

- Under the Warehousing contract, the Grain Owner held a grain contract worth UGX 10,000,000=, and received UGX 14,950,000= at the end of 3 months, which is a profit of UGX 4,950,000=, or 49.5% profit for 3 months.